Your first step is an overview on how the rich keep getting richer.

Have you ever wondered by the rich keep getting richer while broke people stay broke, and the middle class seems to be shrinking?

Well, this isn’t as mysterious as it may first appear, when you examine the specific differences in how broke people, the middle class and the rich spend their money.

Now, this is such a simple concept yet so profound, it nearly knocked me out my chair when I finally understood it.

I’m going to show you exactly how the rich spend their money and you can evaluate for yourself why they keep getting richer and the broke keep getting broker and why the middle class remains so stressed out.

Now, to get started, I’d like to review the “Cash Flow Quadrant” by Robert Kiyosaki and some important financial terms we’ll be using during this presentation.

The terms that you need to be familiar with are:

Cash Flow = Money you bring in.

Expenses = Money you spend.

Assets = Things that pay you.

But let’s review a little bit about “assets.”

This can be a confusing one.

You’re probably familiar with the traditional definition of an asset, which is something you own or have equity in.

However, back in the 1990s, Robert Kiyosaki introduced us to a new definition of an asset in his ground breaking, “Rich Dad, Poor Dad” series of books. Robert taught us that an asset is something that pays you and that’s the definition that we’ll be using here.

Liabilities is the next term, and it’s something that costs you money.

As an example, a house is typically viewed as an asset.

But, can it actually be a liability?

Yes, with our revised definition anything that costs you money is a liability and not an asset.

If you have a mortgage, your house is an asset to your banker, because it pays him every month.

But can a house also be considered an asset to you?

Yes, in the right circumstances it could be.

When it pays you money.

Let’s say you buy a house and you rent it out.

And it paid you a positive cash flow every month after all expenses.

That would then be considered an asset.

Now, one more time with the terms just to be very clear before we continue.

Cash Flow: Money you make.

Expenses: Money you spend.

Assets: Things that pay you.

Liabilities: Things that cost you money.

Now let’s take a look at how broke people spend their money.

Now when I say broke people, I’m not referring to the destitute. I’m speaking about the large portion of our society that lives from paycheck to paycheck, and who never seem to have any money.

In fact, most times there’s more month left at the end their money, and I’m sure many of you can relate to that group.

On pay day broke people buy what I’m going to call, “stuff.”

Well, what’s “stuff?”

That’s inexpensive things that people buy that they don’t really need to survive.

You go into someone’s house and you can’t find any counter or table top space in the whole house because of all the stuff on it. Their house and their cars are full and cluttered with stuff.

But where do they get all that stuff?

They buy it at the flea market, at the garage sales, and the dollar store, at the craft show.

So, the cash comes in…

And then goes straight out the expense column to buy stuff.

You see, broke people never really educate themselves on assets and liabilities.

They justify buying all of this stuff by claiming that it costs so little.

But over the years it’s all they ever have.

The problem is their cash flow never produced or created more cash flow.

Now, please understand, I’m not undermining or taking any shots at this or anything. I just see a lot of financial difficulty out there and it really doesn’t need to be that way.

Creating wealth isn’t a mystery, it’s a formula.

The only reason someone doesn’t create wealth is because they either don’t know the formula or they don’t apply the formula.

Now, let’s take a look at the middle class.

How the Middle Class Spend Their Money

The middle class is the group that society mistakenly thinks are “rich.”

They’re not.

Yes, they typically earn a six figure income and many of them appear rich but it’s what they buy with their money that keeps them prisoners of the middle class.

What they typically buy are liabilities.

Remember the definition of a liability?

Things that cost you money.

By buying liabilities the money gets pushed out their expense column away from them and to other people.

Liabilities are items like cars, boats, houses, airplanes, credit card debt.

Now let’s see just how this happens.

The middle class gets a nice paycheck, let’s say, $10,000 for the month.

They then split that down the middle and they pay their monthly expenses with half and with the other half they make a down payment on a new car.

The car costs $5,000 down and they add on the insurance and the maintenance, that liability now costs $1,100 new dollars every single month.

A few months go by and they want a boat.

Then they want a vacation home. A rolex watch on their credit card. A vacation on their credit card.

And before you know it, their liabilities have raised their expense levels to near or above their income levels.

They actually spend equal to or more than they make.

Meaning, that they have to go to work and make a certain amount of money every single month just to cover their liabilities.

The other important issue with both broke people and the middle class is that normally all of their cash flow is dependent on their own effort.

Meaning, that they’ve educated themselves to exchange their knowledge and expertise for someone’s money.

Also, the money they earn is usually the highest taxed form of income.

Here’s an example.

An attorney is knowledgable about law.

So, people pay them for exchange of that knowledge on an hourly basis.

The problem here is that if the attorney isn’t sharing that knowledge with a client, then the attorney isn’t making any money.

This causes lots of stress and anxiety in their lives, and if you ever ask them to take an afternoon off to play golf with you, well, they very rarely can because of how much money it’ll cost them to take that time off.

On the surface, life’s pretty good.

The reality is that it’s a roller coaster ride.

That’s the middle class.

Now, I know this group very well because for a great deal of my adult life, that was me.

Now, let’s take a look at how the rich people spend their money.

Rich people acquire assets.

Again, an asset is something that pays you.

If you want to become rich, buy assets that earn you more money.

The money cycle looks like this…

Acquire assets that produce cash flow.

Invest the profits to acquire more assets that produce more cash flow.

Invest THOSE profits to acquire more assets that produce more cash flow.

The rich spend their money and acquire more things that produce more money.

Here are a few examples of assets that produce more money:

Investments are the obvious ones.

Stocks, bonds, real estate.

Education is another asset.

If you learn how to do something that produces more money for you, and you actually do it, that’s buying an asset.

There’s a great quote that goes:

“If you think education is expensive, you should see how expensive stupidity is.”

Another example of assets you can acquire that pay you are:

Cash Generating Opportunities.

Especially those opportunities that can create passive cash flow.

Passive, meaning that, once you build it up, the money continues to flow whether you’re still building it or not.

Here’s a small example:

Own a SYSTEM that Creates Passive Cash Flow and Use the Profits to Own More Systems that Create More Passive Cash Flow

Let’s suppose you bought a pinball machine and you put it in a barber shop. And you don’t spend any of the profits.

You save them until you can buy another pinball machine and put it in another barber shop.

This, by the way, was Warren Buffet’s first business.

If you don’t know who Warren Buffet is, he’s one of the top two richest men in America.

The rich are extremely eager to find those passive cash generating opportunities because those opportunities can continue to pay them month after month, year after year, long after they’ve stopped working the opportunity.

You know, I see this happen again and again with successful entrepreneurs.

They find a passive cash flow stream that they build up.

And it continues to pay them month after month, year after year.

They then take those profits and multiply them in another cash generating opportunity and then again in another.

In conclusion, here’s what I’ve learned over the years…

You can’t find these passive cash generating opportunities unless you’re open to hearing about them.

Then once you find them, you must be willing to see what fits you and then take action.

Now, the reason I say this is that, I once answered a hokey little ad that I ended up generating 7 figures from, simply because I answered that ad and then took action.

These opportunities are out there, you just need to find them.

You also must be opportunistic enough that when the right situation does present itself, you don’t miss it.

So remember…

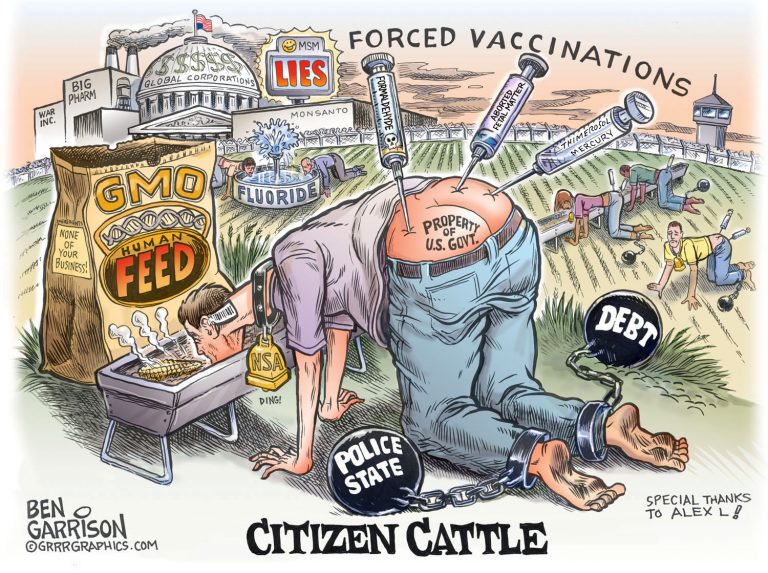

How the Broke Get Broker, the Rich Get Richer and the Middle Class Stays Screwed

Broke people buy stuff.

The midle class buy liabilities.

And the rich acquire assets.

Preferably cash generating opportunities that can create passive cash flow.

They then take that cash flow and invest it in another asset that produces more cash flow.

That’s the wealth creation formula and that’s exactly what using this system will do for you.

Now, if you’re ready to take action on these powerful concepts and start using as asset designed to create cash flow for you, join us and get started.

Click on the button below to continue to learn about this powerful system.

Note: If you need to go back to the beginning and get a list of all the steps, you can click here.

Automated Duplication System

Are you ready for my system to send you big commissions direct to your door? Request your interview here and let's get you started.

About the Author

Hey there I'm Franco Gonzalez. I can help you make money online and simplify the whole thing. I've been teaching this full time for over 18 years. My automated sales duplication system and affiliate marketing school can help you create passive cash flow from home online. Let's connect with any questions.